Introduction

In the fast-paced world of stock markets, where millions of shares change hands every day, certain transactions stand out from the crowd. These notable trades, known as bulk deals and block deals, often signal major market movements and strategic decisions by influential players. Let’s dive into these fascinating aspects of stock market trading and understand their significance in today’s financial landscape.

Bulk Deals: The Market Movers

Definition and Significance

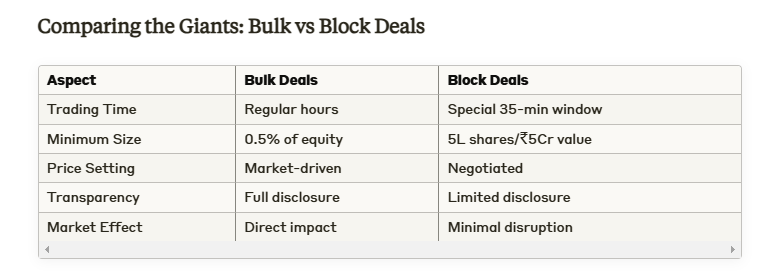

A bulk deal occurs when a single transaction involves more than 0.5% of a company’s total listed shares. Think of it as a large-scale purchase or sale that’s significant enough to catch the market’s attention.

Key Features

- Volume Impact: These deals involve substantial share quantities

- Real-Time Transparency: Complete disclosure of trader details

- Market Influence: Can significantly affect stock prices

- Strategic Value: Often indicates major investor movements

Block Deals: The Silent Giants

Understanding Block Deals

Block deals represent even larger transactions, requiring either:

- A minimum of 5 lakh shares, or

- A minimum value of ₹5 crore

Distinctive Characteristics

- Special Trading Window: Operates for 35 minutes pre-market

- Price Flexibility: Custom-negotiated between parties

- Privacy: Initial trader anonymity maintained

- Minimal Market Disruption: Designed for smooth execution

Comparing the Giants: Bulk vs Block Deals

Motivations Behind Large-Scale Trading

Why Choose These Deals?

- Strategic Positioning

- Building significant company stakes

- Gaining management influence

- Portfolio restructuring

- Financial Management

- Investment rebalancing

- Profit realization

- Risk management

- Corporate Actions

- Facilitating mergers

- Supporting acquisitions

- Enabling strategic exits

Regulatory Framework and Market Impact

SEBI’s Oversight

The Securities and Exchange Board of India (SEBI) maintains strict oversight to ensure:

- Market transparency

- Fair trading practices

- Timely information dissemination

- Prevention of market manipulation

Impact on Market Dynamics

These deals can:

- Signal market sentiment

- Create trading opportunities

- Provide strategic insights

- Influence price movements

Real-World Success Stories

Recent Notable Transactions

- LIC’s Strategic Move (2023)

- Acquired 2.01% stake in IDBI Bank

- Demonstrated institutional confidence

- Influenced market sentiment

- Zomato’s Major Trade (2023)

- 3.4% stake changed hands

- Generated market speculation

- Highlighted investor interest

Smart Investor’s Guide

Making Informed Decisions

- Monitor large-scale trades

- Analyze trader patterns

- Consider market context

- Evaluate company fundamentals

- Watch for institutional moves

Conclusion: The Bigger Picture

Understanding bulk and block deals provides valuable market insights, but remember they’re just one piece of the investment puzzle. Smart investors consider these transactions alongside other market indicators, company performance, and broader economic factors.