Riding the Wave: Trading with the Trend

This highlight the importance of trading with the trend for achieving success in the stock market. This concept is rooted in the idea that stocks in motion tend to stay in motion, similar to Newton’s first law of motion. Identifying and capitalizing on established trends, particularly upward trends driven by institutional buying, is emphasized as a core principle.

Here are some key takeaways from the sources about trading with the trend:

Identify the Prevailing Trend

The first step in trading with the trend is figuring out which way the market is moving—whether it’s going up, down, or sideways. You can do this by looking at price charts and using tools like moving averages.

Example:

- If the price of a stock is consistently making higher highs and higher lows, it’s in an uptrend.

- If the stock is making lower highs and lower lows, it’s in a downtrend.

- A moving average (like the 50-day moving average) can help confirm this: If the price is above the moving average, the trend is likely up; if it’s below, the trend is down.

Identifying the prevailing trend helps you make smarter decisions about when to buy or sell, so you can trade in the direction the market is moving.

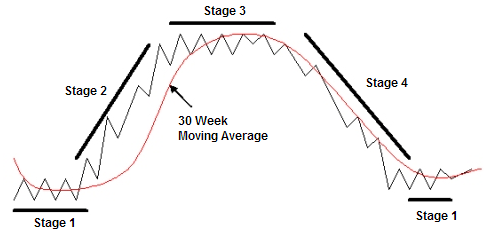

Focus on Stage 2 Uptrends

Stock prices move through four stages, and Stage 2 is when the price is rising because big investors (like institutions) are buying the stock. This stage is the advancing phase, where the stock starts to make steady gains.

Focusing on stocks in Stage 2 is important because it’s when the price is more likely to keep going up, giving you the best chance to make profits. Identifying these stocks early can help you maximize your gains before the price starts to slow down or reverse.

Use the Trend Template

The Trend Template is a set of rules that helps investors find stocks that are in a confirmed Stage 2 uptrend. It uses different technical indicators to check if the stock meets certain price and volume conditions.

For example, the Trend Template might look for things like:

- The stock price is above a certain moving average (like the 50-day moving average).

- The stock is making higher highs and higher lows.

- The volume is increasing, showing more activity and interest in the stock.

By following this template, you can find stocks that are most likely in a strong uptrend, helping you make better decisions about which stocks to buy.

Understand Base Counting

During a Stage 2 uptrend, stocks often go through periods of consolidation where the price moves sideways—these are called bases. Counting how many bases a stock has formed can help you understand how far along the stock is in its upward movement.

Generally, a stock will form 3 to 5 bases before it reaches its peak and starts to slow down. Each base represents a time where the stock is building strength before moving higher again.

Example:

If a stock has risen, then paused and moved sideways for a while (forming a base), and then starts rising again, it’s likely in a Stage 2 uptrend. If it forms 3 to 5 bases before topping out, it can give you clues about how long the stock might keep going up. Counting these bases helps you time your entry and exit better.

Understand Base Counting

As stocks progress through their cycle, they eventually reach a peak and begin to decline. It is vital to recognize these trend reversals and act accordingly, selling positions to protect profits and avoid significant losses. Ignoring these signals can lead to substantial drawdowns, as exemplified by the case of Crocs

Follow the Leaders

Identifying and investing in market leaders, those stocks that exhibit strong relative price strength even during market corrections, is a key strategy. These leaders often signal market turns and provide the greatest potential for rapid price appreciation.

By following the principles outlined here, investors can increase their chances of aligning their trades with the prevailing trend, maximizing their profits and mitigating their risk in the stock market.